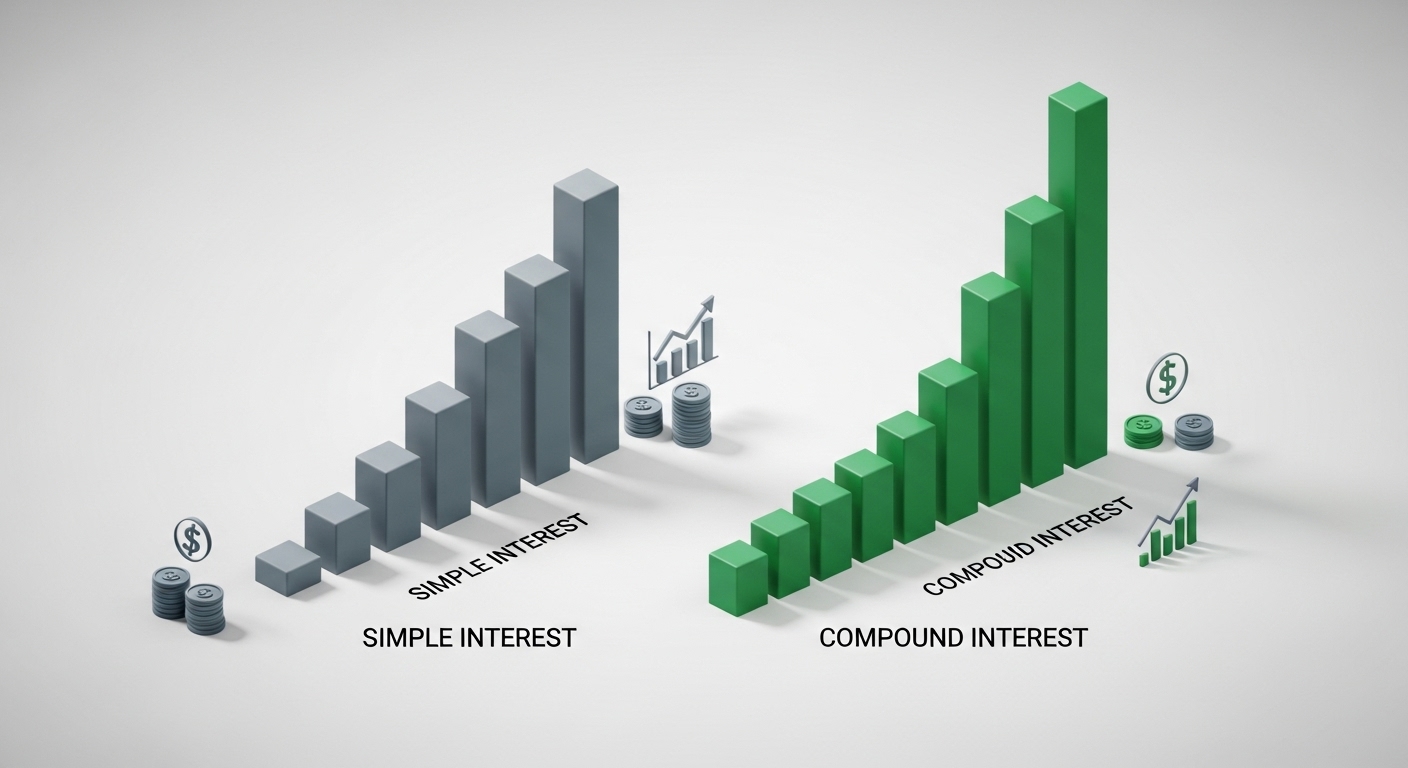

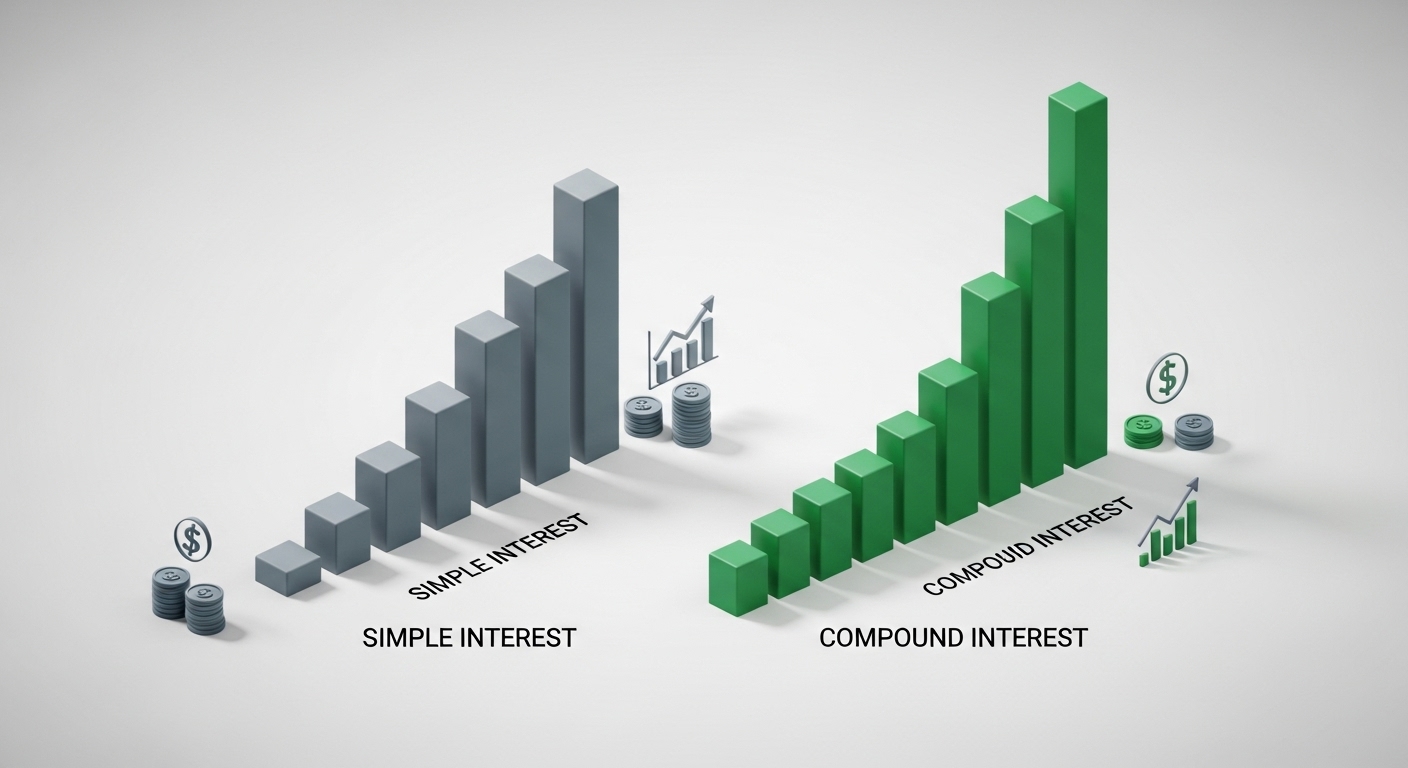

Simple vs. Compound Interest: Why Time is More Important Than Money

Learn the fundamental differences between simple and compound interest and why your start date matters more than your deposit amount.

Master the math behind your money. Our expert-led articles break down complex financial concepts into actionable strategies.

Learn the fundamental differences between simple and compound interest and why your start date matters more than your deposit amount.

A deep dive into the mechanics of daily compounding interest. Learn why the frequency of compounding is just as vital as the interest rate itself.

A comprehensive guide to determining your ideal emergency fund size based on job stability, monthly expenses, and financial volatility in 2026.

A detailed guide on how federal income tax brackets work in 2026, the phenomenon of bracket creep, and strategies to protect your purchasing power.

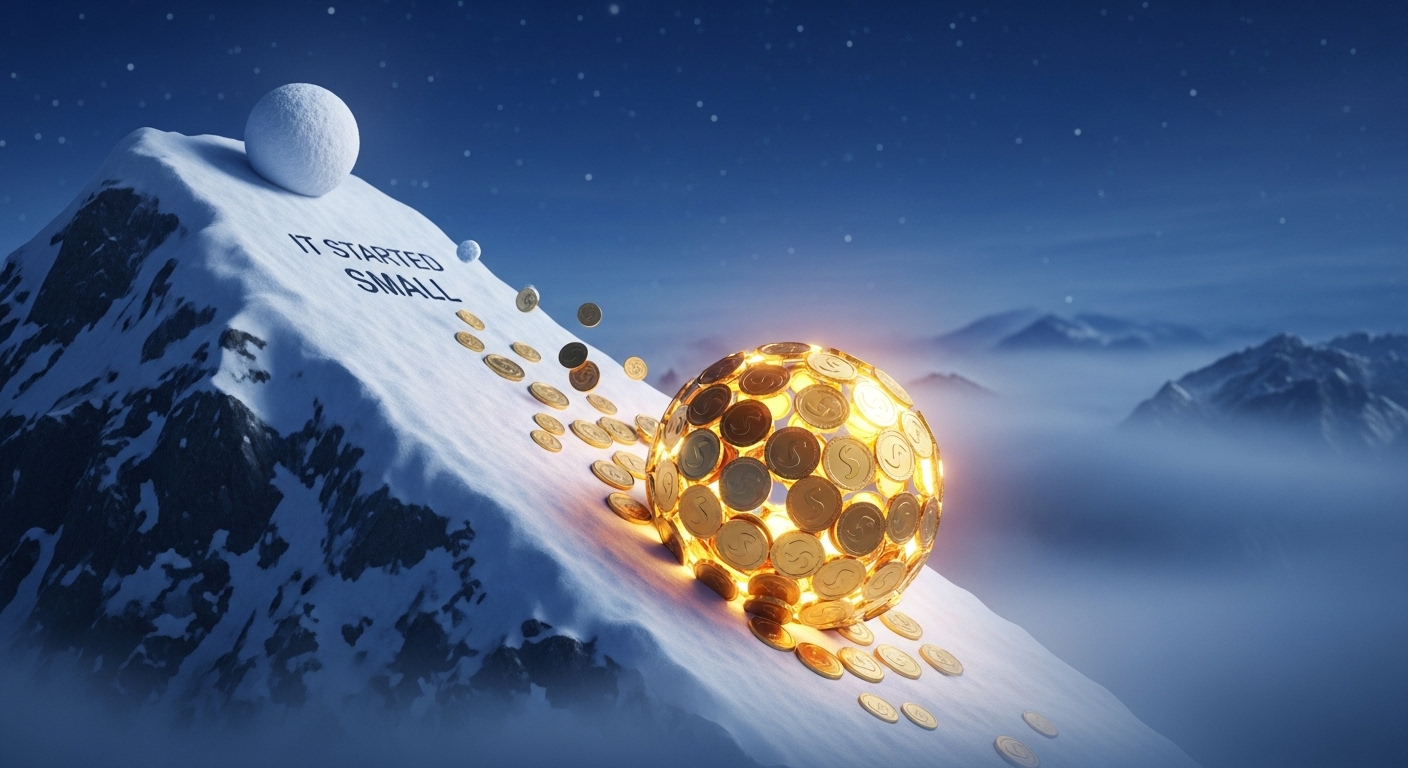

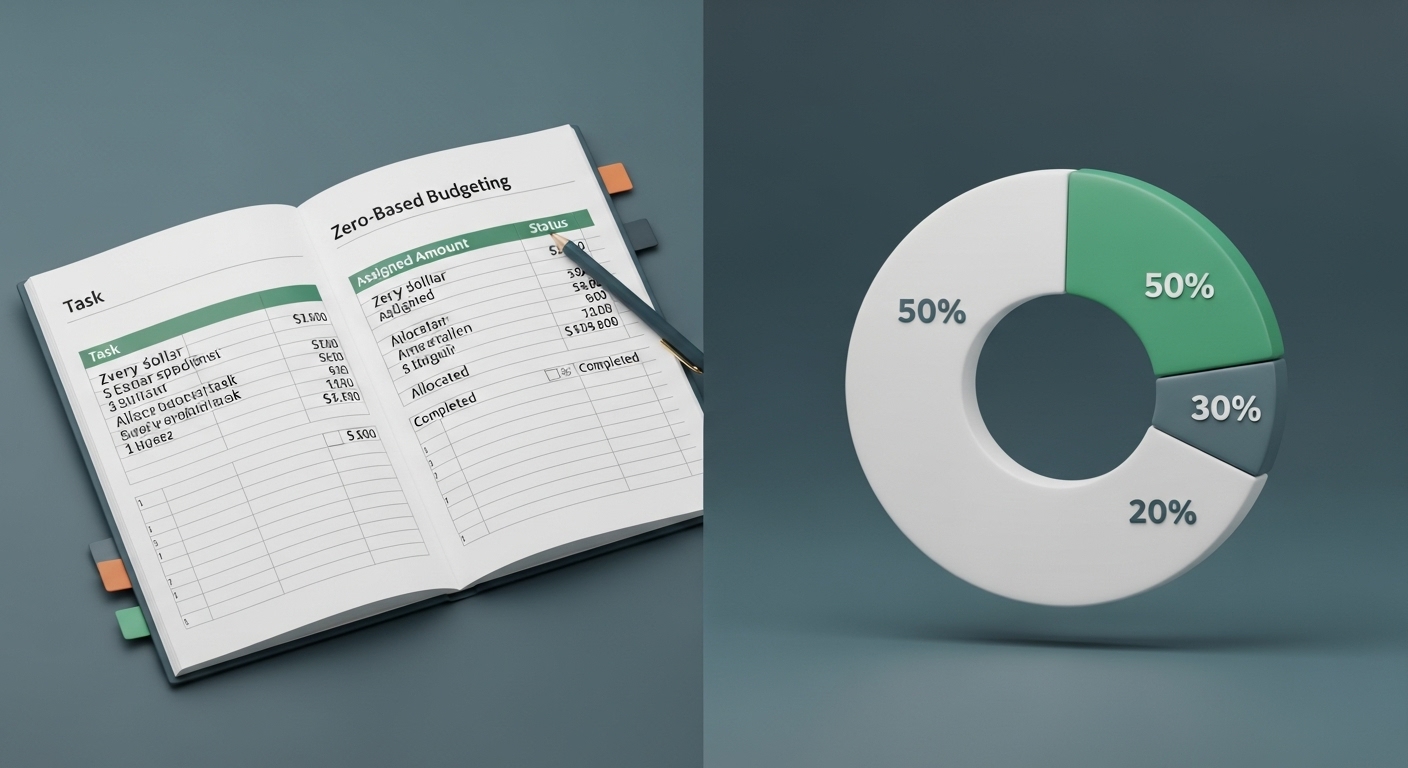

A deep dive into the pros and cons of Zero-Based Budgeting versus the 50/30/20 Rule. Learn which method maximizes wealth and which offers more flexibility.

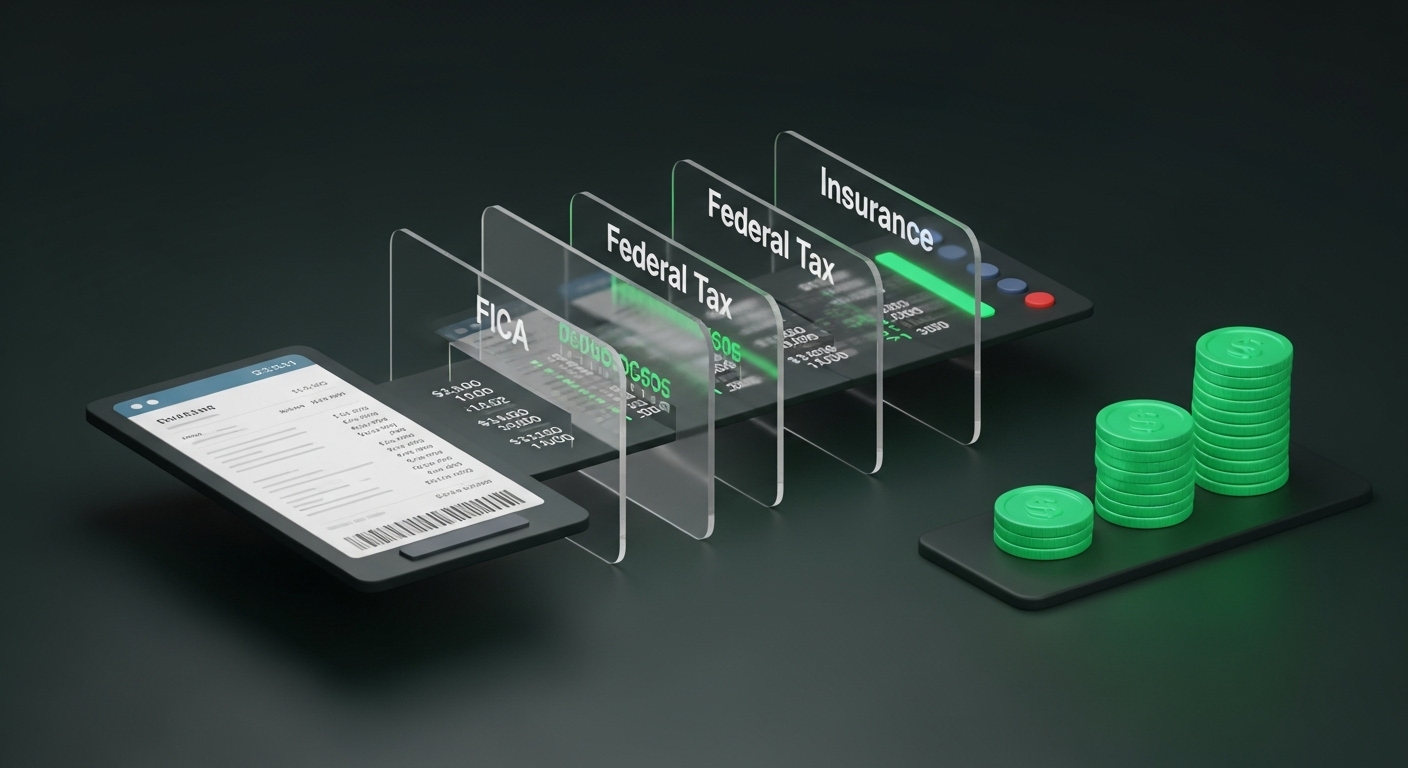

A step-by-step guide to calculating net income, understanding payroll deductions, and using your take-home pay for better budgeting.

A comprehensive, step-by-step roadmap for building an emergency fund, even if you are starting with zero savings in today’s economy.

Learn the formulas lenders use to calculate mortgage affordability. Understand the 28/36 rule, DTI ratios, and how to avoid being house-poor.

See how minimum payments extend your debt by decades and cost you thousands in interest. Learn strategies to break the cycle and pay off credit cards fast.

A data-driven comparison of buying vs. renting in 2026. Learn about the price-to-rent ratio, opportunity costs, and how to calculate your break-even point.

A step-by-step guide to calculating your Debt-to-Income (DTI) ratio. Discover why DTI matters for mortgages, car loans, and how to improve yours before applying.

Compare personal loans and credit card balance transfers for debt consolidation. Learn which method saves you more on interest and helps you pay off debt faster in 2026.

A deep dive into the two most effective budgeting frameworks. Learn how to automate your savings and balance your lifestyle without the guilt.

A comparison of HYSAs and Certificates of Deposit. Discover which liquidity strategy earns you more while keeping your emergency fund safe.

Stop guessing and start growing your score. Learn the technical levers that move your credit rating and how to use debt strategies to boost your borrowing power.

A 10% return isn't always 10%. Learn how to use our ROI tool to compare real estate, stocks, and side hustles side-by-side.

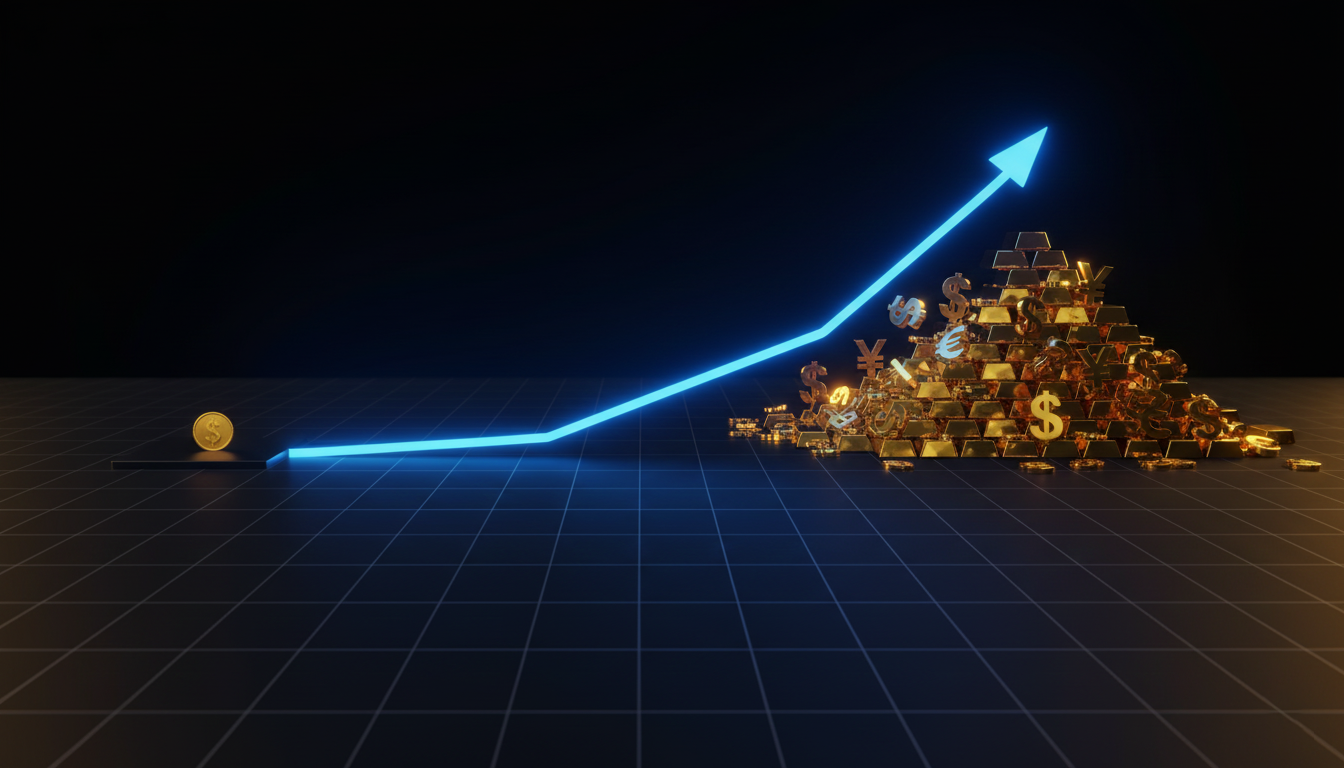

Understand the "Eighth Wonder of the World." We show you how time and consistency outperform high-risk timing in the market.

A comprehensive breakdown of the two most popular debt payoff methods. Learn which strategy fits your personality and how to save thousands in interest.

Try searching for broader topics like "Debt" or "Retirement".