Framework Overview: The Math vs. The Mindset

Before we crown a winner, we must understand the mechanics of each strategy. One is an intensive tracking system, while the other is a broad-strokes guideline.

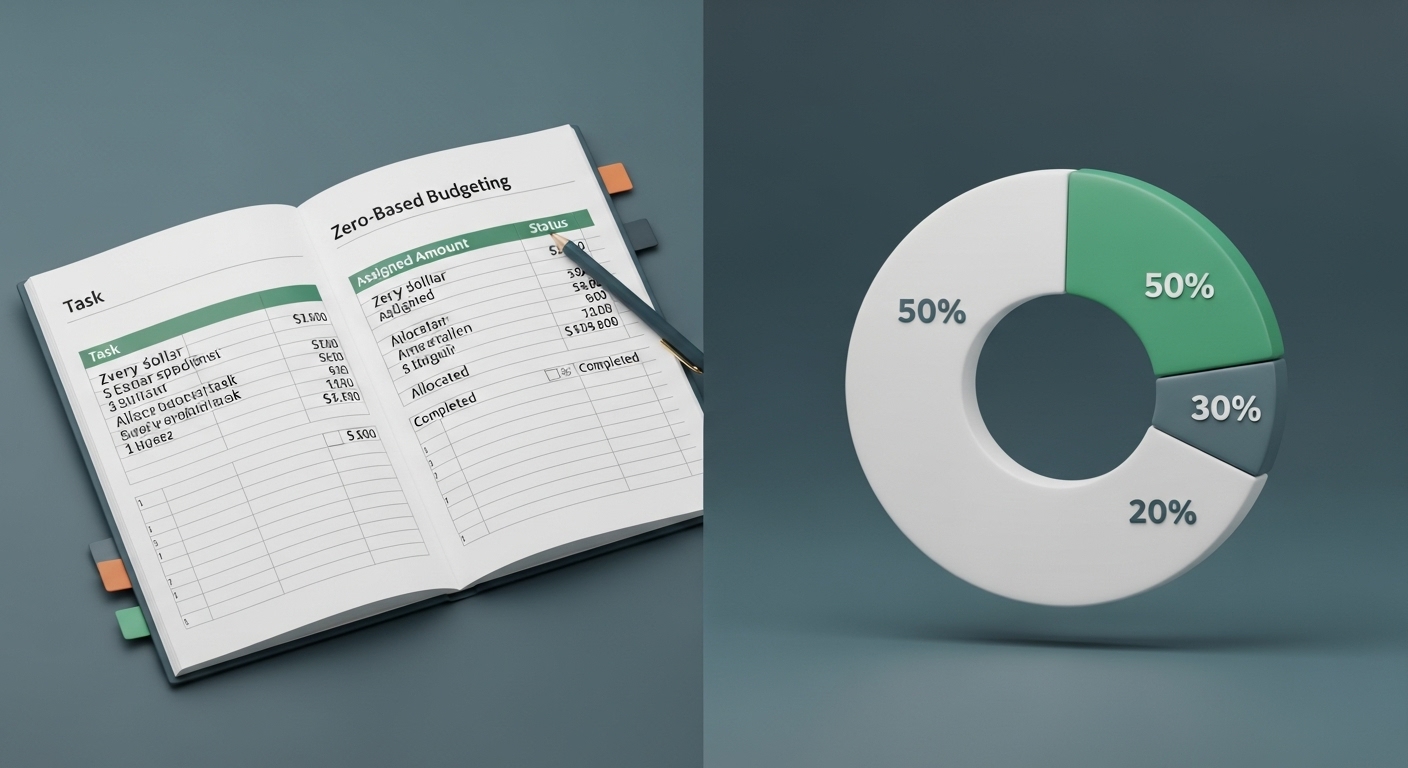

| Feature | 50/30/20 Rule | Zero-Based Budgeting |

|---|---|---|

| Complexity | Low (Beginner Friendly) | High (Detailed Tracking) |

| Flexibility | High | Low (Rigid but Effective) |

| Primary Goal | Balance & Simplicity | Efficiency & Intentionality |

| Ideal For | Consistent Salary Earners | High-Debt or Aggressive Savers |

The 50/30/20 Rule: The Balanced Blueprint

Popularized by Senator Elizabeth Warren, this rule splits your after-tax income into three distinct buckets:

- 50% Needs: Housing, utilities, groceries, and minimum debt payments.

- 30% Wants: Dining out, subscriptions, travel, and hobbies.

- 20% Savings & Debt: Emergency funds, 401(k) contributions, and debt principal.

Zero-Based Budgeting: Give Every Dollar a Job

With Zero-Based Budgeting, your Income minus Expenses equals Zero. This doesn't mean you have no money in your bank account; it means that every single dollar has a mission. If you have $100 left at the end of the month, you must assign it to a "job," such as "Holiday Fund" or "Extra Car Payment."

Which Method Wins for You?

The "winner" depends entirely on your current financial season:

- Choose 50/30/20 if: You are just starting out, find tracking every cent overwhelming, or have a stable financial situation where you naturally save some money.

- Choose Zero-Based if: You are aggressive about debt repayment (using the Debt Snowball), have an irregular income (like freelancing), or feel like your money is "disappearing" without knowing why.

2026 Pro-Tip: The Hybrid Approach

Many successful wealth-builders in 2026 use a **Hybrid Budget**. They use the 50/30/20 rule to set their high-level goals and then use Zero-Based Budgeting within the "Wants" and "Savings" buckets to ensure no money is wasted.

Ready to take control?

Use our professional-grade tools to visualize your strategy and speed up your progress.

Build Your Custom Budget