Simple vs. Compound Interest: The Core Difference

The distinction between these two mathematical models is the difference between working for your money and having your money work for you.

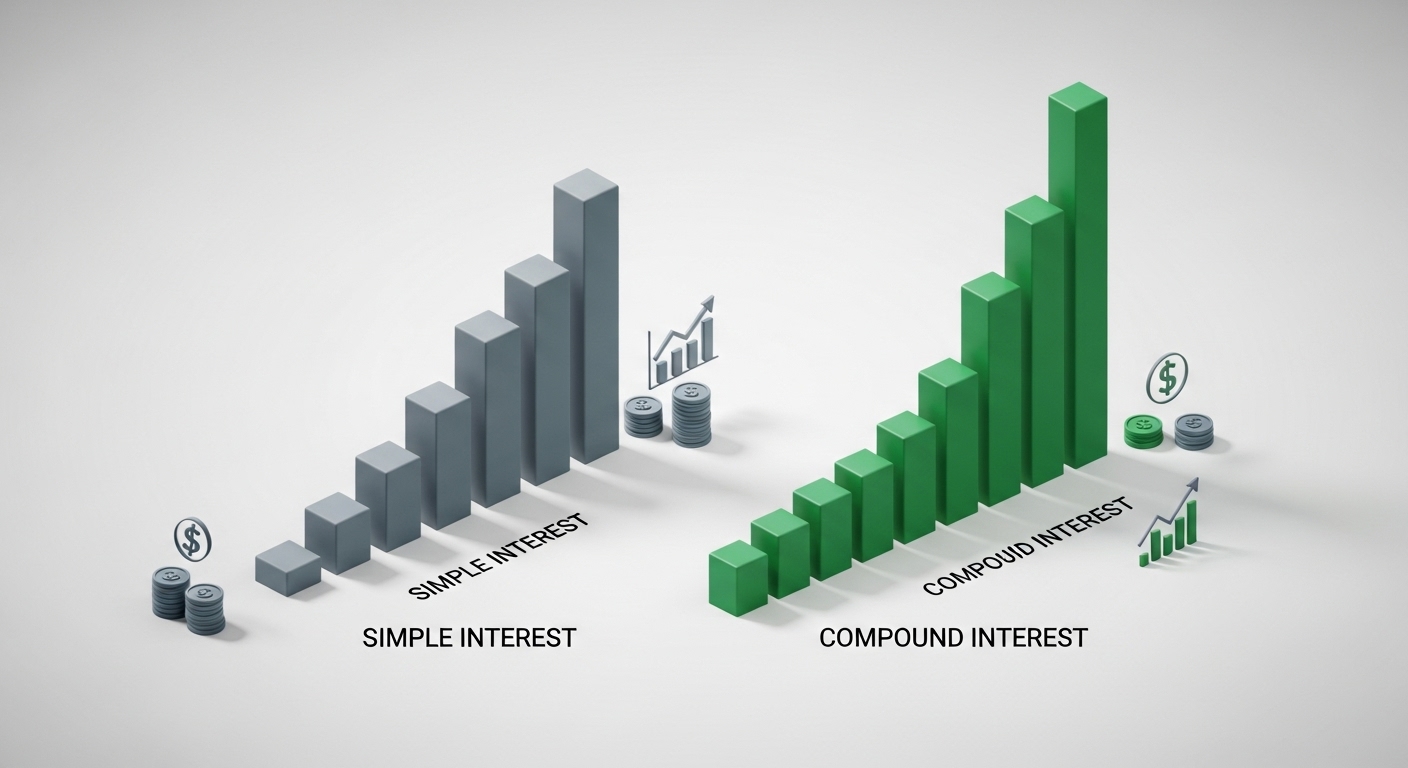

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Calculation Base | Principal only | Principal + Accumulated Interest |

| Growth Pattern | Linear (Steady) | Exponential (Accelerating) |

| Common Uses | Short-term loans, car loans | Savings accounts, 401(k), ETFs |

The "Waiting Tax": Why Early Starters Win

In the world of finance, time is a multiplier. Consider two investors, Alex and Sam, both earning a 7% annual return:

- Alex starts at age 25, invests $500/month for 10 years, then stops entirely.

- Sam starts at age 35, invests $500/month for 30 years until age 65.

Despite Sam investing three times more money than Alex, Alex ends up with a larger nest egg at retirement. Why? Because Alex gave the initial "snowball" an extra decade to gain momentum.

Three Levers of Compounding

To maximize the ROI of your wealth-building journey, you must manipulate these three variables:

1. Frequency

The more often interest is calculated (daily vs. annually), the faster your balance grows.

2. Rate of Return

Even a 1% difference in annual yield can result in six-figure differences over 30 years.

3. Time Horizon

The most powerful lever. Adding 5 years to your timeline is more effective than doubling your monthly contribution.

Final Verdict: Start Today

The best time to start compounding was twenty years ago. The second best time is today. Whether you are using a High-Yield Savings Account or a Brokerage Account, the math remains the same: time is the engine, money is just the fuel.

Ready to take control?

Use our professional-grade tools to visualize your strategy and speed up your progress.

Calculate Your Growth Potential