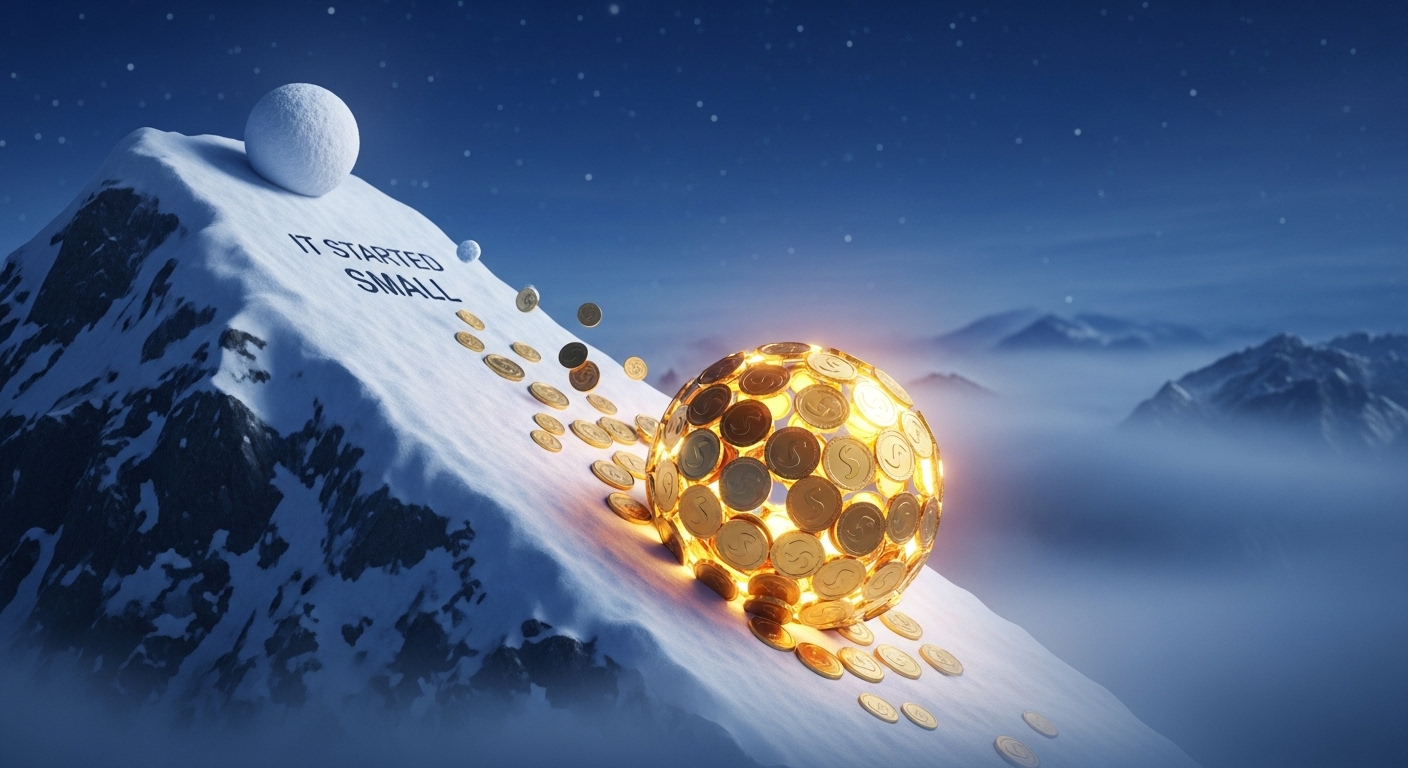

What is the Snowball Effect?

The "Snowball Effect" in finance describes a situation where an initial action (saving $10) builds upon itself, gaining momentum and size as it continues. When you compound daily, you are essentially shrinking the "waiting period" between interest payments. Instead of waiting 30 days for your interest to start working for you, it starts working in 24 hours.

Daily vs. Monthly vs. Annual: The Compounding Gap

To win the "featured snippet" on Google, we have to look at the raw data. The table below illustrates the growth of a $10,000 investment at a 10% interest rate over 20 years, depending on how often that interest is calculated:

| Compounding Frequency | Final Balance (20 Years) | The "Frequency Bonus" |

|---|---|---|

| Annual (Once a year) | $67,275.00 | Baseline |

| Monthly (12x a year) | $73,280.73 | +$6,005.73 |

| Daily (365x a year) | $73,870.32 | +$6,595.32 |

Why $10 Matters: The Power of Micro-Investing

You don't need a massive principal to start. Daily compounding thrives on consistency. By setting aside just $10 a day (the price of a fancy coffee in 2026), you are fueling the snowball.

-

1

Instant Reinvestment: Daily compounding means today's pennies earn interest tomorrow.

-

2

Psychological Momentum: Watching your "Interest Earned" field tick up every 24 hours creates a positive feedback loop.

-

3

Risk Mitigation: Regular daily contributions take advantage of Dollar Cost Averaging (DCA), smoothing out market volatility.

The Formula You Should Know

For the technically minded, the magic happens within this equation:

Where n = 365 for daily compounding.

How to Start Your Snowball in 2026

To take advantage of daily compounding, look for financial products that specifically mention **Daily Sweep** or **Daily Compounding Yields**. This is common in:

- High-Yield Savings Accounts (HYSA): Ensure they compound daily, not just credit monthly.

- Money Market Funds: Often used by brokerage firms for idle cash.

- Crypto Earn Protocols: Regulated stablecoin platforms often compound every second.

Would you like me to draft the next article in your strategy, "Tax Bracket Creep 2026: How Inflation Affects Your Take-Home Pay"?

Ready to take control?

Use our professional-grade tools to visualize your strategy and speed up your progress.

Simulate Daily Compounding