Gross Pay vs. Net Pay: What’s the Difference?

Understanding the terminology is the first step toward masterly budgeting. The gap between these two numbers is where your financial "leakage" occurs.

Gross Monthly Income

Your total earnings before any deductions. For salaried employees, this is usually 1/12th of your annual salary.

Net Monthly Income

Your "Take-Home Pay." This is the liquid cash available for your 50/30/20 budget or zero-based tracking.

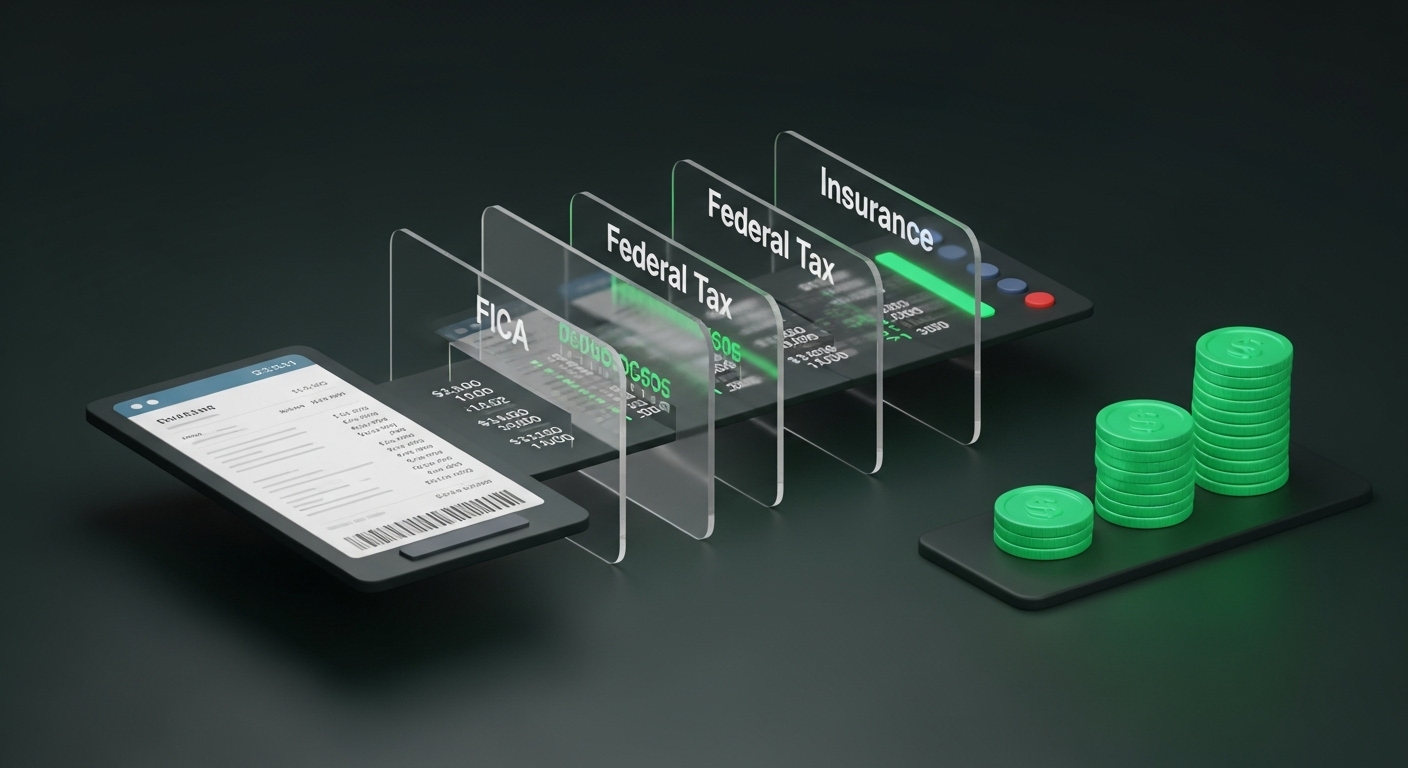

The Deductions Checklist

To calculate your net income accurately, you must account for three distinct categories of deductions:

-

1

Tax Withholdings:

Federal income tax, State income tax, and FICA (Social Security and Medicare).

-

2

Pre-Tax Deductions:

Contributions to a 401(k), 403(b), or Health Savings Account (HSA). These actually reduce your taxable income.

-

3

After-Tax Deductions:

Health insurance premiums (if not pre-tax), union dues, or life insurance payments.

The Calculation Step-by-Step

| Step | Action | Result |

|---|---|---|

| 01 | Identify Gross Pay | Starting Balance |

| 02 | Subtract Pre-Tax Benefits (Retirement/HSA) | Taxable Income |

| 03 | Calculate & Subtract Taxes | Post-Tax Income |

| 04 | Subtract Health Premiums & Other Fees | Net Monthly Income |

Why Your Net Income Matters for Loans

When applying for a mortgage or a personal loan, lenders often look at your gross income for the "Debt-to-Income" ratio. However, you should only ever look at your net income to determine affordability. If your net income is $4,000 but your proposed mortgage is $2,200, you are "house poor," even if a bank says you qualify.

Ready to take control?

Use our professional-grade tools to visualize your strategy and speed up your progress.

Calculate Your Take-Home Pay